Got Soybean Oil?

A surge in soybean oil used as biofuel may be helping drive prices to a historic high.

- Soybean oil prices are trending higher than their historic levels a decade ago.

- Usage of soybean-based biofuel more than doubled in the past eight years.

- Higher prices are likely to drive increased production of the crop.

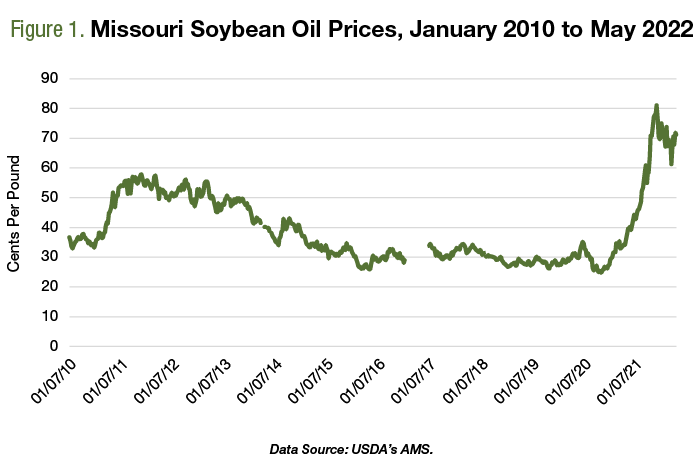

Soybean Oil Prices Surge Higher

Soybeans are a bit unique in that they are a component crop. This means the economic value of growing a bushel of soybeans is derived from the value of the crop’s two primary outputs from the crushing process: meal and oil. Historically, Missouri soybean oil prices hit a high of $0.55 per pound between 2011 and 2012 (Figure 1). After those highs, prices fell to around $0.30 per pound for several years. In 2021, however, prices surpassed historic records. They abruptly jumped briefly above $0.80 per pound and spent most of the year above $0.60. For the entire year, the average weekly price was $0.65 per pound. In other words, the average price for all of 2021 was higher than any single weekly observation since 2010.

For the first five months of 2022, soybean oil prices have been even higher, averaging $0.77 per pound and twice exceeding $0.90 per pound. All else the same, higher soybean oil prices make it attractive for soybean processors to buy and crush soybeans. However, the value of soybean meal and the price of soybeans is also important.

Since 2021, soybean oil has accounted for roughly half of the total value of crushing a bushel of soybeans. This is significant as soybean oil typically accounts for just 25% to 35% of the total economic value. The implication is that the decision to crush soybean — or to build a new crush plant — is heavily influenced by high soybean oil prices.

The USDA provides usage data for soybean oil, including the three primary uses (Figure 2). The largest category of soybean oil usage is the “food, feed, and other industrial uses” category. Over the last 12 years, this category has consistently accounted for 14 billion pounds of soybean oil usage. The smallest category of usage is exports. For 2022-2023, soybean oil exports are estimated at 1.4 billion pounds — the lowest levels in more than a decade.

Early in the 2010s, biofuel accounted for roughly 5 billion pounds of soybean oil usage. Since 2014-2015, however, biofuel usage has more than doubled to 12 billion pounds in 2022-2023. More specifically, over the last eight years, usage of biofuel increased at an average annual rate of 10%. For context, the Rule of 72 reminds us that a 10% growth rate results in a doubling every seven years. Overall, this is a pretty aggressive growth rate, especially considering it’s the only growth category within soybean oil.

Looking ahead, one has to wonder if, or when, biofuel might surpass the food, feed, and other industrial uses category.

While the debate around high soybean oil prices came to the forefront in 2021, the increased biofuel usage trend has been underway for several years. In many ways, the current situation feels a lot like the “food versus fuel” debate that corn and ethanol faced around 2010. This time around, however, a better descriptor might be “doughnuts versus diesel.”

Beyond the data, one doesn’t have to go very far to hear about plans to construct a new soybean crush facility. With soybean oil prices maintaining record-high levels, the situation will undoubtedly incentivize the expansion of production. At the farm level, this demand will likely translate into even more soybean acres. All that said, the price of soybeans and the value of soybean meal will also affect the feasibility of widespread sector expansion. At some point, the industry might be searching for answers on how to utilize all the soybean meal created.

Widmar and Gloy are the co-founders of Ag Economic Insights (AEI.ag). Founded in 2014, AEI.ag helps improve decision making for producers, lenders, and agribusiness through: the free Weekly Insights blog, the award-winning AEI.ag Presents podcast- featuring Escaping 1980 and Corn Saves America, and the AEI Premium platform, which includes the Ag Forecast Network decision tool. Visit AEI.ag or email Widmar(david@aei.ag) to learn more. Stay curious.

#Soybean oil prices are climbing to a historic high, which may lead to increased production of the #crop. Learn what is causing this price hike and how it affects both #growers and end-users, such as bakers.

click to tweet ![]()