Is Working Capital Keeping Up?

- Working capital is an excellent way to measure the resiliency of a farm’s balance sheet.

- Working capital levels across the nation were recently more than 20 cents per revenue dollar.

- Business objectives, risk preferences and rising production costs should factor into working capital goals.

From crop insurance to Farm Bill programs, multiple risk management tools are available for producers. However, working capital, the original and most effective risk management tool, is easy to overlook. Working capital is the difference between short-term assets and short-term liabilities. It measures how much resiliency or shock absorption the farm’s balance sheet provides. During periods of strong profitability and rising production costs, it’s critical to ensure that working capital levels keep up.

Recent History

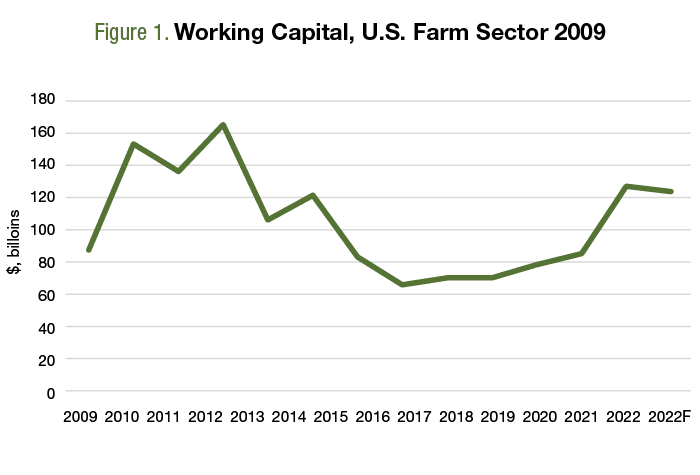

Figure 1 shows working capital across all U.S. farms since 2009. Working capital tends to increase when profits are strong and then get utilized — or burned — during the lean years. For 2022, the USDA forecasts $123 billion of working capital, slightly lower than in 2021 but considerably stronger than the $65.2 billion low of 2016. For additional context, working capital reached a high of $165 billion during the previous farm income boom in 2012.

More working capital is good news. It means the sector-level balance sheet has more capacity to weather potential hiccups. However, given rising production costs, total dollars — or dollars of working capital per acre or per head — doesn’t provide a complete story.

Figure 2 shows working capital relative to gross revenue. For 2021 and 2022, working capital levels exceeded 20 cents for every dollar of revenue for the first time since 2014. Here again, levels are improved from those in recent memory, but not nearly as strong compared to 2009 to 2014.

How Much?

The question is always asked, “How much working capital is sufficient?” The "Farm Financial Standards Council categorized working capital levels above 30% of gross revenue as “strong” and levels below 10% as “vulnerable.” While a useful starting point, each farm must determine the appropriate levels given their unique operations, future plans, and overall risk preference. For example, an operation with a majority of acres owned and little debt might set a lower goal than operations with more debt or expansion plans.

Wrapping It Up

Working capital is often a warning light closely monitored during periods of financial stress in the farm economy. Unfortunately, producers have few options for improving their position when profits are squeezed. With 2023 in focus, producers should review their operations working capital trends and set goals based on their business objectives and risk preferences. In addition to setting goals for total dollars of working capital, it’s also important to ensure those dollar thresholds are sufficient, given rising production costs.

David and Brent are the co-founders of Ag Economic Insights (AEI.ag). Founded in 2014, AEI.ag helps improve producers, lenders, and agribusiness decision-making through 1) the free Weekly Insights blog, 2) the award-winning AEI.ag Presents podcast - featuring Escaping 1980 and Corn Saves America, and 3) the AEI Premium platform, which includes the Ag Forecast Network decision tool. Visit AEI.ag or email David (david@aei.ag) to learn more. Stay curious.

click to tweet ![]()